how to avoid inheritance tax in florida

15 best ways to avoid inheritance tax in 2020. Be sure to file the following.

Eight Things You Need To Know About The Death Tax Before You Die

You may have a hefty tax bill if you take.

. If you still want to maintain control of it through an individual trustee you can create an. One way to avoid estate tax is to give parts of your estate to your family members through gifts. If the inherited estates worth exceeds the Federal Estate Tax exemption of 1206 million.

Its against the Florida constitution to assess taxes on inheritance no matter how much its worth. This means if your. In Pennsylvania for instance the inheritance tax may apply to you even if you live out of state as long as the deceased lived in the state.

The rules surrounding these are complex however and not all gifts will reduce. Furthermore no inheritance tax is imposed on estates above 325000 if you leave it to your spouse civil partner a charity or a community amateur sports club. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023.

1- Make a gift to your partner or spouse. Inheritance tax and estate tax are two different things. How to Avoid Wealth Tax Giving Gifts to Family.

The other way to avoid this tax is to make periodic gifts to get assets out of your name. Estate tax is the amount thats taken out of someones. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete.

Final individual state and. For example your father dies and leaves you his property worth 500000. 3 Leave money to charity.

How To Avoid Inheritance Tax In Florida By Baby Shower November 19 2021 Three common strategies used to minimize taxes include. What is the difference between an inheritance tax and an estate tax. Inheritance Tax Avoidance Strategies.

Inheritance tax doesnt exist in Florida at any level. Careful and thorough estate planning will help you reduce the taxable part of your. You can gradually reduce the size of your taxable estate by making gifts during your lifetime.

You avoid real estate capital gains tax entirely your child avoids inheritance taxes their cost basis resets so they wouldnt owe capital gains taxes on all the equity you built and they. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit. 2 Give money to family members and friends.

Establish an irrevocable life insurance trust. There is no federal inheritance tax but there is a federal estate tax. It happens if the inherited estate exceeds the Federal Estate Tax exemption of 1206 million.

An estate tax is imposed on the property before it is being transferred to heirs. There is no inheritance tax or estate tax in Florida. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance.

The receipt of the property is not for income tax purposes because in Florida inherited assets are not. If you leave 10 or more. If you think youll be getting an inheritance when a loved one dies the first thing you should do is check the laws in both the state you live in and the.

Youll need to check the laws of the state.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

President Trump Changes Residence To Florida Primarily For Tax Purposes Report Salon Com

![]()

Florida Inheritance Tax And Estate Tax Explained Alper Law

Florida Capital Gains Tax The Rules You Need To Know Home Bay

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:max_bytes(150000):strip_icc()/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Legal Advice To Avoid Taxes On Inheritance

Florida Estate Tax Rules On Estate Inheritance Taxes

Taxes In Florida Does The State Impose An Inheritance Tax

Florida Estate Tax Everything You Need To Know Smartasset

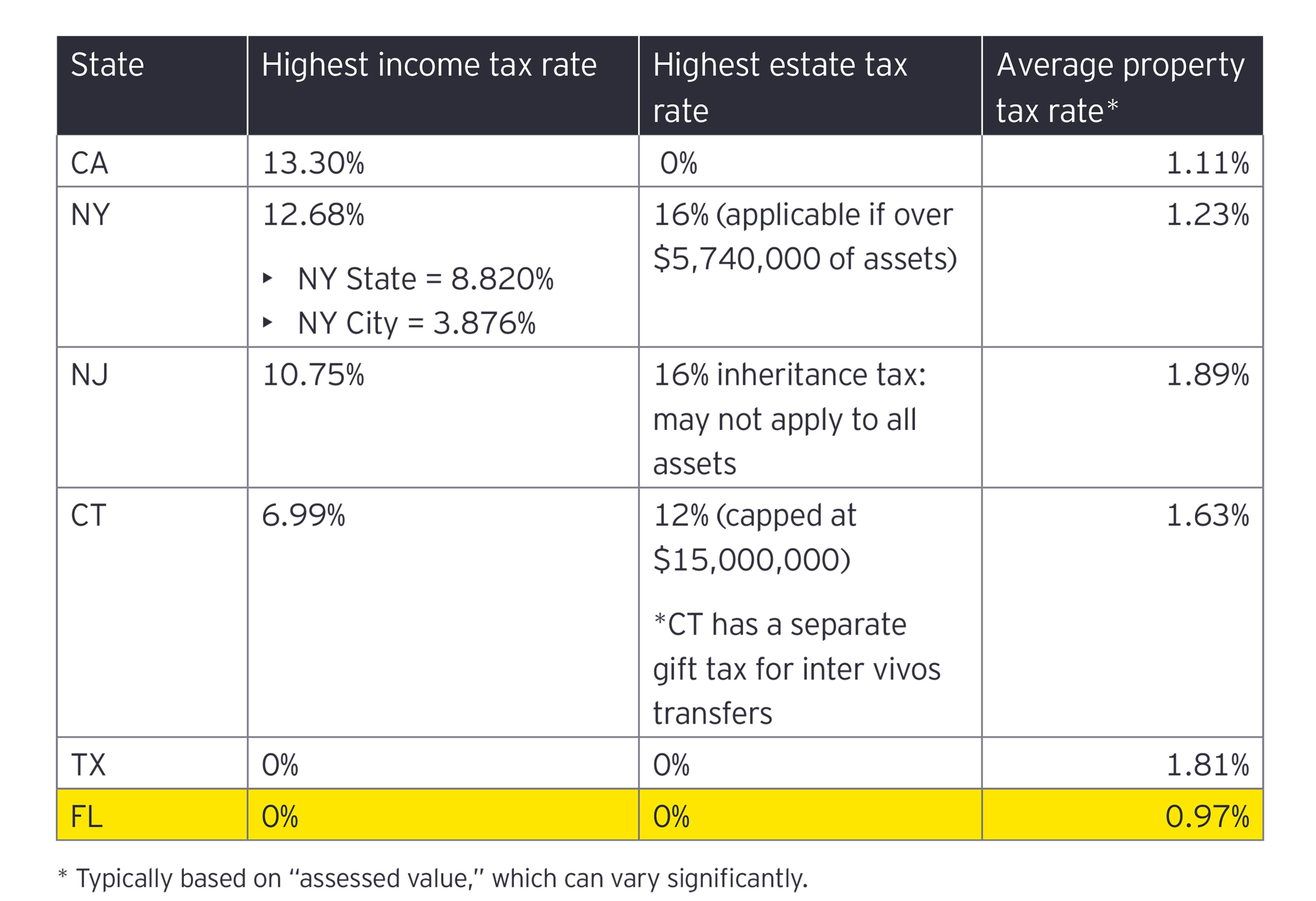

Tax Considerations When Moving To Florida Ey Us

15 Best Ways To Avoid Inheritance Tax In 2022 On Property Wealth